India-UK FTA Deal: A Boon to India's Economy

According to a recent report by BofA Securities, India is on track to become the world's third largest economy in 2031 (fiscal 2031-32), and would surpass Japan's nominal GDP in that year. The forecasts are based on a six percent real growth rate, five percent inflation, and two percent depreciation rate. India is currently the world's sixth-largest economy by nominal GDP and third-largest by purchasing power parity (PPP), and the Foreign Trade Agreement (FTA) negotiations agreement would put the UK’s businesses ahead of the pack in supplying India's burgeoning middle class, which is expected to reach a quarter-billion consumers by 2050. With a population larger than the United States and the European Union combined, India is on track to become the world's third largest economy by 2050.

The UK government describes the free trade agreement (FTA) negotiations with India as a ‘golden opportunity’ to chance upon the front row in the Indian economy.

The first round of discussions is likely to begin next week, making it the UK's shortest commencement of formal talks between negotiating teams following a launch, according to the British government. International Trade Secretary Anne-Marie Trevelyan will meet with her Indian counterpart, Commerce and Industry Minister Piyush Goyal, to formally begin talks on an agreement that might benefit both countries significantly. Below are some of the major advantages expected from the deal.

The Benefits

- An India-UK FTA is said to benefit both countries greatly, with the potential to expand bilateral trade by up to GBP 28 billion a year by 2035 and raise salaries by up to GBP three billion.

- Increase in trade with India by 2030, by boosting the expansion of the UK’s trade relationship, which reached 23 billion pounds in 2019.

- Lowering trade obstacles for the UK exporters – Simply eliminating tariffs would boost exports to India by 6.8 billion pounds, supporting tens of thousands of jobs across the UK. Important UK exports such as Scotch whiskey and automobiles are currently subject to 150 percent and 125 percent tariffs, respectively.

- The UK expects the lowering of barriers to conduct business and trading with India's GBP two trillion economy and 1.4 billion consumers, including tariff reductions on British-made automobiles and Scotch whisky exports, according to the Department for International Trade (DIT).

- Levelling up the UK - A trade agreement with India may benefit the economy of all of the UK's nations and regions, according to DIT analysis. In the West Midlands, for example, around 30,000 people were employed by Indian investment in 2019, and the region may see a major boost of up to 300 million pounds from chances for motor vehicle and components manufacturers.

- Investment in UK jobs - International investment from Indian companies already supports 95,000 employments in the UK, and with a new trade pact, that number might rise.

- Boosting of the UK’s green industries - By 2022, the Indian government expects to add 175 GW of renewable energy capacity, with much more planned in the decades ahead. The UK's world-leading renewables industry is expected to profit from a deal that removes hurdles such as import taxes of up to 15 percent on UK-made wind turbine parts.

- A deal with India would also be a ‘big step forward’ in the UK's post-Brexit goal to refocus trade on the Indo-Pacific, which is home to half the world's population and 50 percent of global economic growth.

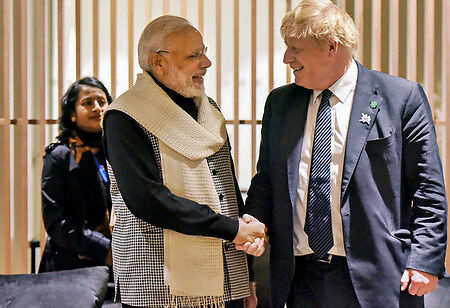

“A trade deal with India’s booming economy offers huge benefits for British businesses, workers and consumers. As we take our historic partnership with India to the next level, the UK’s independent trade policy is creating jobs, increasing wages and driving innovation across the country”, says British Prime Minister Boris Johnson.

The Supporting Factors

Two additional drivers, according to BofA Securities, are a currency reserves cushion and softer real lending rates, which could help the country become the world's third largest over time.

Since the Reserve Bank of India has built up the country's foreign-exchange reserves, it is likely to aid in stabilizing the Indian rupee and preventing severe depreciation during global shocks. It is also expected to attract more portfolio inflows and cut borrowing costs for Indian businesses.

Newly opened up and sunrise sectors such as internet-enabled services, space, atomic energy, coal and mineral mining, renewable energy, defence manufacturing, food processing, electronics, semiconductors, and others, just as software, pharmaceuticals, and automobiles did in the first flush of post-liberalisation growth explosion, can throw up a new set of global champions that will propel India into the league of the top three nations (by GNP).

If all else had happened according to plan, BofA Securities predicted that the Indian economy was anticipated to achieve its economic milestone by 2028, but due to the Covid-19 outbreak, it has been pushed back three years, leave alone existing concerns aggravated by the pandemic.

The Discouraging Factors

Rising oil costs, which can fuel inflation, are a source of concern, according to BofA, and represent a danger to the forecasts.

“Sustained $100+/barrel (bbl.) oil would push the current account deficit beyond the sustainable two percent of GDP level and pose a downside risk. Estimate FY22 current account deficit at 0.8 per cent of GDP at $ 60/bbl. Every $10/bbl. increase the current account deficit by $ 9 billion/0.3 percent of GDP”, added Indranil Sen Gupta, India Economist, BofA Securities.

Aside from rising commodity prices, particularly crude oil, analysts suggest that an increase of Covid-19 cases across the country is another danger that might derail the fragile economic recovery in the short-to-medium term. The impact, on the other hand, will be less severe than that of a full-scale lockdown in 2020.

“The resurgence of pandemic cases in the state of Maharashtra is a matter of concern, but it is too early to consider it a pan-national second wave. We do not yet see this as a threat to our medium-term outlook, as virus resurgences in other countries have proven less economically disruptive than originally feared,” according to Sonal Varma, managing director and chief India economist, Nomura.

Tailwinds to growth remain intact from the lagged impact of easy financial conditions, fiscal activism, strong global growth and the ‘vaccine pivot’ point, Nomura said.