Addressing Developmental Challenges: Enhancing Financial Inclusion through Microfinance

Manoj holds a master's degree in Management from JBIMS, has completed the 'Strategic Leadership in Microfinance' course from Harvard Business School, "Strategy meets Leadership" course from INSEAD, and "Leading for Impact" from IMD Lausanne. A seasoned professional, he is also the Vice Chairperson of the Governing Board of MFIN India.

Manoj holds a master's degree in Management from JBIMS, has completed the 'Strategic Leadership in Microfinance' course from Harvard Business School, "Strategy meets Leadership" course from INSEAD, and "Leading for Impact" from IMD Lausanne. A seasoned professional, he is also the Vice Chairperson of the Governing Board of MFIN India.

On a daily basis, over 1 lakh employees of 150 odd microfinance institutions cover close to three million borrowers in various centre meetings across 30 states and five UTs across India.

In 2006, Dr (Prof) Mohammed Yunus’ Grameen Bank in Bangladesh were conferred the Nobel Peace Prize for providing a viable financing mechanism to the underserved segment of our society and helping them with a first loan to improve their livelihood.

Microfinance is the business of giving small-size loans with more frequent repayments to a population representing the Bottom of the Pyramid segment with a Joint Liability agreement at a “centre place” close to where they live.

In India, microfinance, a novel concept to provide collateral free, micro-loans to the unbanked sections of society, started as early as the 1980s with SEWA Bank.

But it picked up pace in the mid-2000s with SKS Microfinance leading the transition to an NBFC. With banks recognizing microloans as a well-performing asset class coupled with demand for Priority Sector Lending assets, debt followed.

Many others transitioned from a Not for Profit to an NBFC structure and by 2007, a new growing asset class had been firmly established. Investments came and in 2010, SKS Microfinance did a first-ever IPO in India for a microfinance institution.

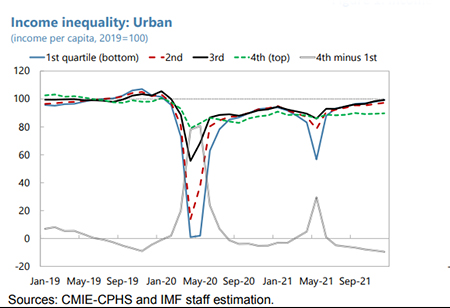

As per IMF study illustrated in the 'Income Inequality: Urban' figure on the right, the pandemic caused income inequality to spike as those in the bottom income quartile lost nearly all income while the top quartile only saw a 20 percent reduction.

As per IMF study illustrated in the 'Income Inequality: Urban' figure on the right, the pandemic caused income inequality to spike as those in the bottom income quartile lost nearly all income while the top quartile only saw a 20 percent reduction.

Inequality rose again during the second wave of the global pandemic, especially in urban areas.

India, being the most populous nation in the world with over 1.4 billion people is naturally the biggest opportunity in microfinance.

Our Honourable Prime Minister quoted in one of his Independence Day speeches “There is a school of thought that financial inclusion is not always good...but if we look at the pyramid of development in the country, the base is the broadest. If that is strong, the pyramid will be strong. When the purchasing power of the last person in the line will increase, economy will grow”.

He often highlighted the role of microfinance in providing access to finance to millions especially, women at the BoP. While poverty levels moderated as per the latest Niti Aayog figures, the income disparity is starker post pandemic and needs intervention to move towards a sense of equality.

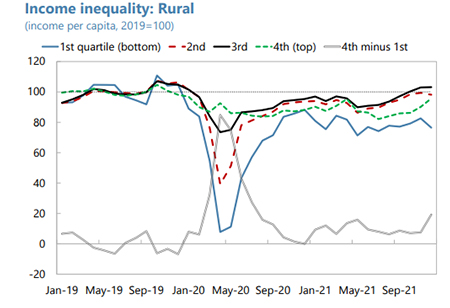

In the second figure under 'Income Inequality: Rural' on the right, though back to pre-pandemic levels by the end of 2021, incomes for some groups remain lower than before, like the urban top quartile and the rural bottom quartile.

Financial Inclusion as defined by the Reserve Bank of India (RBI), broadly seeks to provide access to the key basic requirements of any adult individual – bank account, savings, credit, insurance, pensions, and investments from the formal sector.

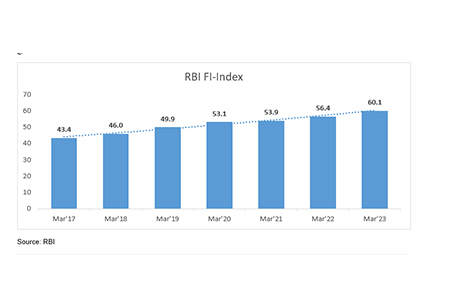

The RBI also publishes a Financial Inclusion Index which reflects the progress on this key focus area for the government and the central bank.

As shown in the statistics on the left, the RBI's financial inclusion index rose to 60.1 in March 2023, reflecting growth in financial inclusion across all parameters tracked by the index. However, the East, North-East, North, and Central regions of India remain to be the focus areas.

Micro Finance Industry Network (MFIN), India’s first RBI recognized Self Regulatory Organization (SRO) quarterly publishes update on the sectors’ progress.

As per their report, as of September 2023, over 71 million borrowers across 30 states & UT’s were active with a credit portfolio outstanding of over INR 3.7 lac crores.

From less than INR 100Cr in 2005 to this size is a significant achievement but the reality is even at this level the market penetration is just about 33 percent with 67 percent still either using informal sources or with no access to credit.

With the above in context, it is pertinent to note that when it comes to lending to the BoP, questions around eligibility, process, lending & collection practices would be areas of interest and dialogue rightfully so. Let us look at a few facts for a better understanding of this business:

- The RBI as the regulator has clear guidelines on microfinance: Any lending to a household with income upto INR 3 lacs per annum, credit guidelines with no more than 50 percent of the income towards debt repayment, pricing guidelines and also a code of conduct on collection/recovery practices.

- Microfinance is an ‘unsecured’ business and while in normal state, it has delivered over 99 percent collections with less than one percent credit costs (better than some secured assets!). Any ground level issue causes a disruption of the discipline on payments leading to higher delinquency & credit costs.

- It follows a ‘door step’ service delivery model as the lender goes to the borrower near their work/stay place rather than the reverse. This builds in additional employee and occupancy costs – almost six to seven percent is taken up by these costs for a microfinance entity. Of course at a higher scale and size, it moderates to about five percent.

- Most observers feel a 24 percent pricing is too much bordering on a ‘usurious’ level. What they miss is that this is a reducing balance interest rate – essentially for an INR 100 loan for a period of a year, a borrower would end up paying about INR 12 as interest. Of that INR 12 over 50 percent goes as debt costs of the lender! Even the Malegam Committee, appointed by the RBI to look at microfinance, suggested 26 percent reducing balance as a possible maximum rate for the business in 2011.

- So how does a borrower who takes a loan at 24 percent per annum, still manage to repay? A vegetable vendor buys goods worth INR 100 in the morning and sells all by evening at INR 110 – this works out to a 10 percent return on that day. Assuming about 250 working days, this is 2500 percent per annum! The operating secret is the inventory turnover on a daily basis.

- If the borrower has no access to regulated microfinance then what does she / he do? The local informal credit provider charges 5 to 10 percent flat per month based on the security offered – over 60 to 120 percent per annum!

- Lastly, for microfinance institutions, cash is the raw material funded by equity and debt.

To attract equity investors, the business has to be a viable and sustainable one – a minimum 15 percent ROE on a sustainable basis is required to make it attractive for a potential investor (endorsed by the Malegam Committee Report as well in 2011).

These will help us gain a better perspective on business and the fact that microfinance is clearly, the most effective tool for providing access to banking services for people locked out of traditional avenues to finance. Thereby it accelerates financial inclusion and empowers women and rural borrowers.

Two important recent developments have been very conducive – first, the RBI’s definition of microfinance segment with uniform guidelines on credit assessment, and second, the clarity from the Supreme Court about the sole regulator for NBFCs and banks being RBI to avoid any conflicting dual regulation from the State governments. These have further helped strengthen the industry’s purpose of making formal credit accessible to the bottom of the pyramid.

Access to formal finance is a critical parameter that needs to be addressed with robust infrastructure in place – conducive policies, access to equity, PSL debt from banks, payment gateways, JAM trinity, and active credit bureaus amongst others. It is important that the above be leveraged and credit & repayment discipline be strengthened which will bring down credit costs and help lower the pricing for microfinance loans. This will help attract equity capital from both domestic & overseas to help grow the scale & size. With all this, the sector is poised to play its rightful role in a national priority – Financial Inclusion & Access to Finance.