Germany Eyes India as Key Partner in Reducing Reliance on China

Chancellor Olaf Scholz is travelling to New Delhi this week with a high-ranking delegation in efforts to strengthen Germany's ties with India as part of a drive to reduce reliance on China. Germany is looking to India's vast market to diversify its trade relationships, just as the nation grapples with an economic contraction and mounting trade tensions between the European Union and China. German businesses are optimistic about India's future, particularly by the rich pool of highly skilled human resources, lower costs, and fast-paced economic growth at an estimated 7%.

Chancellor Olaf Scholz is travelling to New Delhi this week with a high-ranking delegation in efforts to strengthen Germany's ties with India as part of a drive to reduce reliance on China. Germany is looking to India's vast market to diversify its trade relationships, just as the nation grapples with an economic contraction and mounting trade tensions between the European Union and China. German businesses are optimistic about India's future, particularly by the rich pool of highly skilled human resources, lower costs, and fast-paced economic growth at an estimated 7%.

Scholz's visit symbolizes the de-risking strategy that Germany adopts as a reaction to problematic dependence on Russian gas that left the country vulnerable after the Ukraine war back in 2022. Similar concerns have now mounted for Germany's biggest trading partner, China. Despite its leading position, German firms are looking to India for opportunities: Direct investments in the country amount to about € 25 billion in 2022-a percentage of around 20% of Germany's investment in China. According to head of foreign trade at the German Chamber of Commerce (DIHK), Volker Treier, it can increase up to 40 % by the end of the decade.

"China will not disappear, but India will become more important for German companies", Treier said. "India is the litmus test. If de-risking from China is to work, India is the key because of its market size and economic dynamism".

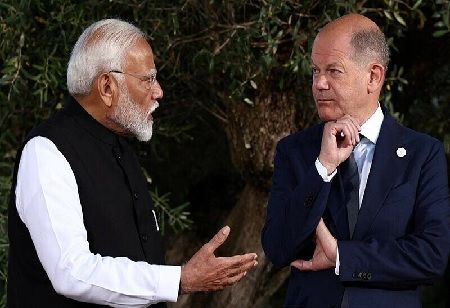

In the seventh round of German-Indian government consultations, the delegation headed by Secretary General Scholz will meet with Indian Prime Minister Narendra Modi. Economy Minister Robert Habeck is scheduled to open the Asia-Pacific Conference of German Business in New Delhi.

German businesses bet on the long-term potential of the Indian market, putting aside all the challenges that lie in bureaucracy, corruption, and a complex tax system. An AHK report compiled by KPMG recently revealed that 82% of Indian revenue is expected to grow for German firms within the next five years and 59% of them plan to expand their investments – up from 36% last year.

As an example, DHL-the giant logistics major from Germany is ready to invest half a billion euros in India by 2026 with the boom in India's e-commerce sector contributing to it. "We see huge growth potential in the Asia-Pacific region, and India has a substantial share of it", said DHL's division head Oscar de Bok.

Volkswagen, which has lately experienced declining sales in China and high production costs in its parent market, is searching for joint ventures in India. The company already operates two plants in the country and signed a supply agreement with Indian partner Mahindra in February. "India has been growing in importance for us", the German automaker's CFO Arno Antlitz said, citing potential in the market and uncertainty created by the relations between the U.S. and China.

Another engine manufacturer from Cologne, Germany, entered India this year: Deutz is partnering with TAFE, the world's third-largest tractor manufacturer. TAFE Motors will produce 30,000 Deutz engines annually under license. "Political stability and low labor costs are the key arguments for India", said Jonathan Brown, managing director at BCG. "India should be a key part of any 'China + 1' strategy".

This comes as German interest in India is on the rise and coincides with a record trade between the two nations in 2023. The country is on the verge of surpassing Germany and Japan and entering the decade as the world's third-largest economy. India offers German companies a set of opportunities to grow outside China, yet is still fraught with issues-ongoing negotiations of a free trade deal between the EU and India are long in the making but so far, inconclusive after years of negotiations.

However, German companies see enormous potential in the country, provided they adjust their strategies. "The hurdles to gaining a foothold in the market are high but once you're there, you have great potential", Brown of BCG said.