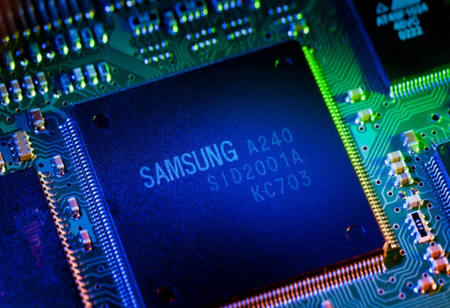

Samsung Pours in $116 Billion to Reinforce its Chip Manufacturing

Samsung Electronics is all set to intensify its chip manufacturing and is investing about $116 billion into its next-generation chip business including fabricating silicon for external clients. With this initiative, the company is trying to bridge the gap on industry leader Taiwan Semiconductor Manufacturing within two years from now.

Last month, the company’s senior executive has stated that they would mass produce 3-nanometer chips in 2022. Thus, the company is trying to churn out the industry’s most advanced semiconductors the same year as its Taiwanese rival expects to pass that milestone.

However, Samsung has initiated its work on developing initial design tools with key partners, Park Jae-hong, executive vice-president of foundry design platform development, states the conference delegates.

In the event, Samsung’s Park states, “To actively respond to market trends and lower the design barrier for competitive systems-on-chip development, we’ll keep innovating our cutting-edge process portfolio, while strengthening Samsung’s foundry ecosystem through close collaboration with partners.”

If Samsung wins, that will be a breakthrough for its ambition to become the chipmaker of choice for the likes of Apple and Advanced Micro Devices that now rely on foundries like TSMC.

However, the business isn’t new to Samsung, that has been the first manufacturer of Apple’s A-series iPhone processors, but, the company’s renewed push is now shepherded by billionaire heir Jay Y Lee, who prefers to see it grow tech leadership across advanced sectors like chipmaking and 5G networking to power its next phase of growth.

Park’s comments hint that Samsung is accelerating its bid to fight with iPhone-chipmaker TSMC, one of the biggest beneficiaries of this year’s wave of stay-at-home demand for personal electronics.

“Samsung is catching up to TSMC very fast and it seeks to achieve dominance over its competitor by adopting the new technology for the first time. However, if Samsung can’t improve production yields of the advanced node fast in an initial stage, it may lose money,” says Rino Choi, a professor of materials science and engineering at Inha University.