Step-Up SIPs Explained: How a Step-Up SIP Calculator Enhances Your SIP Investment Strategy

Many investors prefer mutual funds, often choosing a Systematic Investment Plan (SIP) to invest a fixed amount monthly. SIPs are convenient, easy to manage, and encourage disciplined savings. A popular variation, the Step-Up SIP, allows investors to periodically increase their contribution, aligning with income growth and enhancing returns over time. This combination of flexibility and growth potential makes SIPs, particularly Step-Up SIPs, an attractive choice for achieving financial goals.

Many investors prefer mutual funds, often choosing a Systematic Investment Plan (SIP) to invest a fixed amount monthly. SIPs are convenient, easy to manage, and encourage disciplined savings. A popular variation, the Step-Up SIP, allows investors to periodically increase their contribution, aligning with income growth and enhancing returns over time. This combination of flexibility and growth potential makes SIPs, particularly Step-Up SIPs, an attractive choice for achieving financial goals.

What would happen if you could make your SIP investment even more productive? That is what the Step-Up SIP and the Step-Up SIP Calculator are for. Here, let's discuss what a Step-Up SIP is, how it works, and how you could upgrade your SIP investment strategy with the help of the Step-Up SIP calculator.

What is a Step-Up SIP?

What is a Step-Up SIP?

A Step-Up SIP, often popularly referred to as Top-Up SIP, allows you to top up your SIP amount at regular intervals. Instead of investing the same amount every month, a step-up SIP allows you to increase the SIP amount gradually, along with increasing your income or savings.

Suppose you start a SIP for ₹5000 per month. You can start a Step-Up SIP wherein the amount is raised by 10% every year. So, you invest ₹5000 in the first year, ₹5500 in the second year, and so on. Incremental investment allows you to receive the maximum return from the investment without burdening your pocket too much at this point in time.

Why You Might Like a Step-Up SIP

A Step-Up SIP provides you with quite a few reasons why it's well-suited for you as an integral part of your overall investment strategy:

1. In line with inflation -your income will be increasing over the years.

Everyone undergoes growth in his or her income over a period of time- whether it is through promotions, hikes, or bonuses. And with Step-Up SIP, you can change your investment in accordance with your increasing pattern of income. Instead of making uniform investments every year, you can invest more as you earn more, and so on.

2. Beat Inflation

Inflation devours the worth of your money over a period of time. For instance, increased SIP contributions through a Step-Up SIP ensure that the investments are very much in step with rising inflation for the accumulation of a bigger corpus in the long run, hence translating into growing wealth in real terms.

3. Financial Goal in Shorter Period

If you are saving money for long-term goals like saving for your child's education or house or retiring comfortably, then a ramp-up of SIPs can help you realize the goal much sooner. In fact, a Step-Up SIP accelerates your wealth-creation process and gives you more with time.

4. Compounding Works in Your Favor

As the investments in mutual fund schemes are compounding, that simply means after a return is acquired, it will be directly invested to generate returns on that, too. The more you invest in a Step-Up SIP, the more will the power of compounding work for your profit. The more you invest, the higher your returns over time.

What is the Meaning of a Step-Up SIP Calculator?

A Step-Up SIP Calculator is a planning tool that enables you to know the amount of wealth you may be able to accumulate by steadily increasing the SIP amount in the future. It helps you gauge the influence of stepping up your SIP contributions on your future returns.

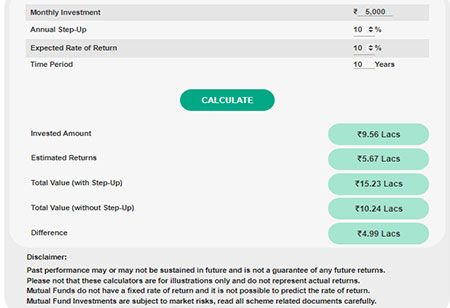

Step-Up SIP Calculator Asks for the following inputs:

- The amount at which you want to begin SIP.

- Your increase in SIP (for instance, 10% every year).

- Length of investment or the number of years you invest.

- The rate of return you expect from the mutual fund.

- Using this input, the calculator computes how much your investment would grow with regular step-ups over time. This will help you plan even better and develop a clearer picture of your future growth.

How to Use a Step-Up SIP Calculator?

To use a Step-Up SIP calculator is very simple and doesn't need any technical knowledge; simply follow these steps:

Step 1: On the SIP calculator interface.

Click on the field saying 'amount.' Enter the desired amount of your monthly investment. Here, for example, we are assuming that you want to start a SIP of ₹ 10,000 monthly.

Step 2: Step-up Percentage Input

Enter the percentage at which you want to raise your SIP every year. Popular step-up percentages include a 10% increase. However, this completely depends on how mature your funds are and your comfort in spending them.

Step 3: Input of Investment Tenure

Now, choose the number of years you want to invest. For example, if you want to save for 15 years, you should key the value into the calculator.

Step 4: Enter the Expected Rate of Return

Finally, you need to enter the expected rate of return. This again varies depending on the nature of the mutual fund you're putting in. Equity mutual funds can have a high return rate around 10-12 percent while debt funds offer more stable and lower returns around 6-8 percent.

Step 5: Calculation of Returns

Once you fill in all the information required, the calculator will give an approximate value of your investment at the end of your investment period. Additionally, it will also disclose the potential of your starting SIP and the increased contributions up to.

Calculating Example for Step-Up SIP

Let's understand how a Step-Up SIP works in real-world applications through an example:

- Initial SIP amount =₹10,000/- per month

- Step-Up percentage =10% hike in every year

- Investment duration: 15 years

- Expected Rate of Return: 12%

Using the same inputs in a Step-Up SIP calculator, you will observe that after 15 years, your investment would have gone up much more than if you had invested ₹ 10,000 every month at constant rates.

Without a step-up, what would happen is your SIP of ₹ 10,000 per month at 12% return over 15 years could grow to about ₹50.6 lakhs. But if you had a 10% annual step-up, the same investment could grow to over ₹80 lakhs!

That's the huge difference a step-up in SIP can make for you if you are growing your investments by some percentage annually.

Disclaimer: The figures used in this example are for illustrative purposes only and are based on assumed rates of return. Actual returns from mutual fund investments may vary due to market conditions and other factors. Past performance does not guarantee future results. It’s advisable to consult with a financial advisor to understand how a Step-Up SIP strategy aligns with your financial goals and risk tolerance.

Why use a Step-Up SIP Calculator?

A Step-Up SIP calculator is just the right tool to plan your investments. Here's why you should use one:

1. Planning for the Future

The Step-Up SIP calculator allows you to estimate how much you will be able to accumulate over time using the Step-Up SIP strategy. That helps you prepare for future financial goals-a house, funding education for children or retirement plans.

2. Helps in the Decision-Making Process

It gives you a clear picture of how different scenarios will affect your returns if you are still unsure how much to invest or how much to increase SIP each year, making it easier to make informed decisions about investments.

3. It motivates you to invest more

It can motivate you to increase your contributions and see the potential growth of your investments. The small increase in your SIP turns out to be significantly high returns, which encourages disciplined and consistent investing.

Things to Keep in Mind While Using a Step-Up SIP Calculator

Though the step-up SIP calculator is so efficient, there are a couple of things that one needs to take care of:

1. Market Risk

The returns presented by this calculator are based on the assumed rates of returns. Still, returns may vary based on the fluctuations in the market that might occur. The mutual fund investment carries risks owing to the operation of the market. Historical performances also cannot guarantee future performances.

2. Step-Up Percentage

Though a 10% annual step-up is fairly common, you will have to decide on a percentage that suits your pocket. Do not over-extend your budget too much because the additional amounts taken through SIP need to be sustained in the long run.

Conclusion

A Step-Up SIP is one of the most efficient ways to increase your SIP investment strategy. Compounding, keeping pace with inflation, and increasing one's wealth are some benefits offered by this type of SIP. With the help of a Step-Up SIP calculator, you can plan your investment better as it gives a clear-cut idea of how stepped-up contributions will affect your future returns.

If you want to get the most out of SIP investments, then increasing contributions and planning on a calculator can really make wonders happen! This is just one simple strategy that can work real wonders towards reaching that financial goal.